Refinancing your home can have major benefits: a lower monthly payment, cash use of home equity for a variety of purposes, generate more appetizing mortgage terms, etc. However, there are a few things to remember when entering into a mortgage refinance, like refinance cost.

Here are a couple of cost options to remember when you’re ready to refinance your home:

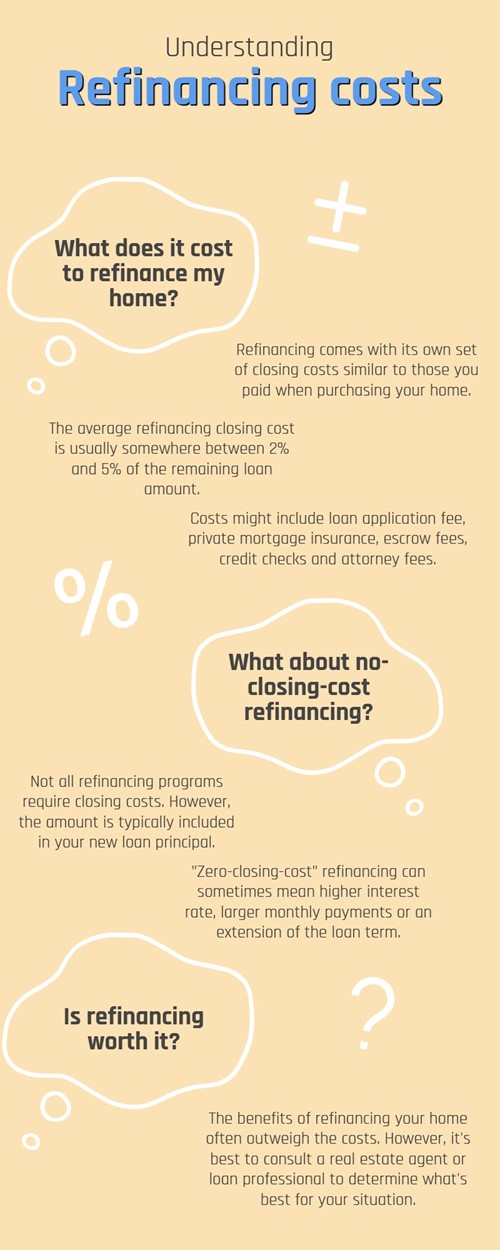

The biggest group of refinancing costs that you should be aware of is the closing costs. While you may not have to pay the same closing costs you did when you first purchased the house, there’s a good chance you’ll need to pay at least 2% of the remaining mortgage loan, but typically no more than 5%.

Average closing costs may include your loan application fee, private mortgage insurance, escrow fees, credit checks, attorney fees and any other property-related payments. However, these fees are based on the individual loan provider

Some refinance programs don’t require you to pay closing costs. No-closing-cost refinance options are often considered if the closing costs on your new loan don’t quite fit into the budget. The costs are typically added in with your new loan principal and may come up as higher interest rates, larger monthly payments or an extension of the loan term.

Refinance closing costs are typically part of the refinancing game, which may cause some homeowners to turn away from refinancing. However, the benefits of refinancing may outweigh the costs, and with a plethora of options available for a variety of financial situations, there’s a good chance you’ll find the right mortgage refinancing program for your circumstance.

If you need an extra bout of insight but don’t know where to start, try your real estate agent and the network of loan and finance professionals they may have at their disposal.

“I sell your home like it's mine”

A licensed real estate salesperson since 2016, Rob is affiliated with the Briarcliff Manor office of Corcoran Legends Realty. He serves buyers, sellers, renters, in Westchester, Rockland, and Putnam counties. Rob, a native of New York and Westchester County for most of his life, brings an extensive local knowledge of both residential and commercial properties to the table. His experience includes a wide range of property types – single-family, multi-family, condos and mixed use. “Hard to sell” properties is where Rob really excels. “There’s no problem that cannot be solved.”

Rob is certified for many different disciplines in real estate. Cartus Relocation Network Agent, AARP Agent, National Tenants Network (NTN) Agent, Green certified and Pricing Strategies Master. In addition, Rob has completed the Leader’s Edge Advanced training to better serve his clients. Rob has been both associate of the month and top closed dollar agent.

When you work with Rob, you get the feeling you’re his only client. Numbers don’t count, you do. Clients always come first. Each transaction is handled as if it were his own home. Rob strives to make the process as seamless as possible and takes care of all the details, no matter how small. His clients rave about his above-and-beyond service and prompt informative communication. Rob is easy going, friendly, and patient. However he can be a determined and aggressive negotiator when the need arises.

When not out actively working on behalf of his clients, Rob spends time with his wife and two teenage daughters. A devoted supporter of community he sits on several local boards and volunteers for numerous locale nonprofit organizations. He enjoys cycling, hiking, kayaking and winter skiing.

“May your price be right, and your sale be swift!”